Owning generic, market-like portfolios has never been interesting and today it could be dangerous. Fundamental risks are rising as are risks associated with historically expensive valuations. Given relatively low return expectations for the market, protecting capital and generating excess returns through active management are more important than ever. Read on to learn about BBH’s approach.

At Brown Brothers Harriman & Co. (BBH), we take pride in the fact that our Firm is the oldest and largest partnership bank in the United States. Our core values of teamwork, integrity, and excellence have guided us since our founding just over 200 years ago in 1818. Our Firm has witnessed many financial innovations throughout its history, but narrowly missed the inception of the U.S. Municipal market. Municipal bonds were first issued in the U.S. in 1812 to help finance the Erie Canal in New York. For many decades, we have successfully invested in Municipals for a wide range of institutions, wealthy individuals, and for BBH, itself.

Nowhere in the world of fixed income is there a sector more diverse than Municipals. With tens-of-thousands of issuers, dozens of bonds structures, and over one million individual securities, Municipal bonds come in a myriad of shapes and sizes. These bonds help finance critical infrastructure such as water and sewer systems, schools, airports, and hospitals. Other non-essential projects such as golf courses, executive airports, and parking facilities sometimes qualify for funding in the Municipal market as well.

The Municipal market is unique because of its household-dominated ownership base. All other fixed income sectors are predominantly owned by institutions. This has several important ramifications for valuations and market behavior. First, household investors possess a distinct set of preferences for:

- General Obligation bonds within their state of residence

- AA-rated or higher bonds

- Current income

- Maturities of 10 years or less

- Bonds not subject to the Alternate Minimum Tax (AMT) or call risk

All else equal, securities with these characteristics are typically priced more expensively than other varieties. Second, history and experience tell us that the compensation for bearing Municipal credit risk is often much higher than the risk of default. This is particularly true for investment-grade securities that fall outside of the comfort zone of typical household investors. Third, the Municipal market is periodically subject to high levels of volatility that cannot be justified by fundamentals. Time and again, household investors exhibit herding behavior during good markets and bad, which creates market momentum and volatility independent of valuations and credit fundamentals.

As a result of its diversity, fragmented household ownership base, and valuation distortions, we find that the Municipal market offers attractive opportunities for active management. Although we invest for a wide range of clients and our Firm, we share the same objective for all the capital entrusted to us:

- First — protect our investors’ capital;

- Second — generate attractive risk-adjusted returns

Prioritizing capital preservation may seem conservative and old-fashioned. We all know that when bonds deteriorate, their prices can fall as fast as equities. Consequently, in order to generate attractive risk adjusted returns, it is imperative to avoid credit problems.

To achieve our goals, we employ a bottom-up, research intensive, value-driven strategy that stands in contrast to the mainstream approach in the fixed income management industry. We seek to own a limited number of durable credits that we purchase at attractive yields. Unlike many others, there are no committees in our investment process as our team makes all investment decisions collaboratively.

Consistent with our desire to protect our investors’ capital, we only consider credits that we believe to be fundamentally sound under a wide range of circumstances and economic conditions. Unlike in equities, value investing in bonds benefits from contractual maturity dates. If the market fails to recognize the value we have identified in our securities, we can simply hold them, earn the yield, and get our capital back at maturity. Our strategy is predicated on the credit remaining intact, and the depth of our research gives us the confidence to hold positions for long time periods or to maturity, if need be.

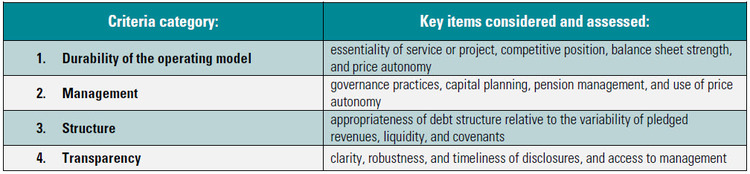

To develop this confidence, we assess credits against criteria in the four following areas:

Once we are satisfied with the merits of the credit supporting a bond, we have to assess its return potential. Although the effects of overpaying for a security are not as deleterious as having a credit problem, we want to avoid it nonetheless. We take many variables into account when we assess a bond’s return potential. For starters, we evaluate our bonds over a base three-year horizon. Of course, we want to be compensated for its credit, interest rate, liquidity, and embedded structural risks, but we do not stop there.

We also seek to establish a margin of safety by demanding compensation for a bond’s volatility. Although we do not consider volatility as a risk, it plays an important role in determining the attractiveness of a potential purchase. As value investors, we have a better chance of finding opportunities when markets are bouncing around. We typically own our bonds for years, so our entry points are critically important. A bond’s maturity, quality, cyclicality, and structure all factor into our required margin of safety1.

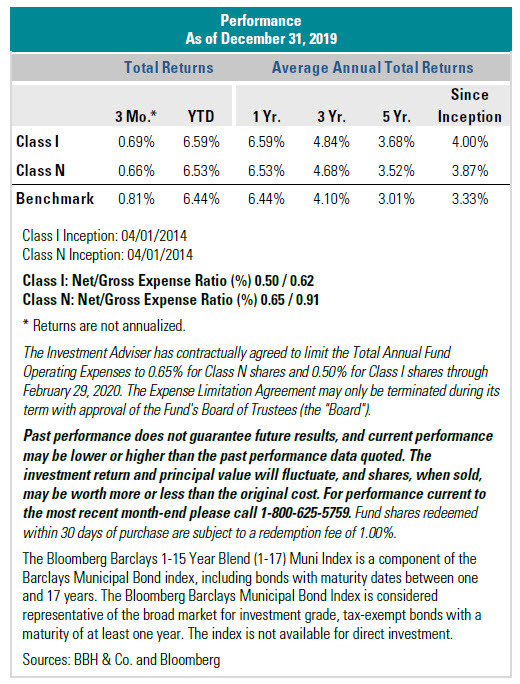

While this approach may sound simple, it is not easy to execute well in practice. Success depends on our discipline, patience, and on attracting the right clients who appreciate our philosophy and process. Over the years, we have developed a core competency in saying no to credits that don’t satisfy our research requirements, or to bonds that do not offer sufficient compensation. A wide range of market environments during the last five years tested our strategy and team.

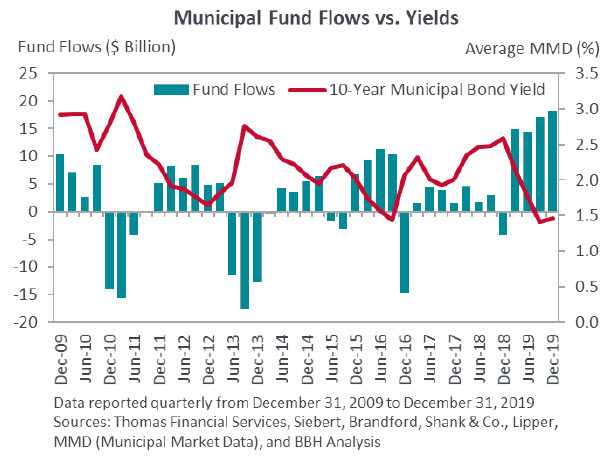

The period began with the Fed well-entrenched in their Zero Interest Rate Policy (ZIRP). By the time it ended, the Fed had tightened monetary policy nine times for a total of 225bps2, yet the 10-year muni yield is lower today. As confounding as we find that fact, it serves as a good reminder of why our process is focused on investing in undervalued securities, rather than forecasting interest rates or other macro variables.

From late-2015 to mid-2016, the municipal market enjoyed its longest bull market on record — fourteen consecutive months of positive returns! Although rewarding from the perspective of short-term performance, attractive long-term opportunities were in short supply. Consistent with our approach, our purchase activity hovered at or near multi-year lows for several consecutive quarters. In our investment commentaries, it is always fun to discuss new opportunities. In 2016, we started writing about bonds we didn’t buy! No bull market lasts forever, and the muni market was seriously jolted by the surprise Presidential election soon after. Although that sell-off was short-lived, we invested significant client capital in the abundant opportunities that were available. Patience pays off when you can name your price and buy from forced sellers.

It took nearly two years for another big buying opportunity to emerge. We heard echoes of the Financial Crisis during the fourth quarter of 2018 and once again took advantage of market volatility and the redemption-driven selling of other managers. Market sentiment has swung back to positive and, as of this writing, we are back to spectating, rather than buying. We are both comfortable and proud to decline one bond after the next, knowing that we are prepared to act decisively when market conditions are replete with opportunities.

At BBH, we view our interests as aligned with those of our clients. We understand that if we can help our clients succeed and meet their goals, then we will succeed as a firm. All too often in today’s investment world, managers assess their risk and success on a relative basis. We never subjugate our research to benchmark construction and go to great lengths to protect our clients’ capital from impairment. We know what we own and why — and you will never hear “because it’s in the index” at BBH. We are proud of our long-term track record and believe it serves as an effective proof statement of the efficacy of our strategy, the strength of our team, and the care with which we execute.

Our approach may seem old-fashioned, but generating strong investment results never goes out of style.

Gregory Steier

Managing Director

Head of Tax-Exempt Portfolio Management and Inflation-Protected Securities

A credit rating is an assessment of the quality of a borrower. Issuers with credit ratings of AA or better are considered to be of high credit quality, with little risk of issuer failure. Issuers with credit ratings of BBB or better are considered to be of good credit quality, with adequate capacity to meet financial commitments. Issuers with credit ratings below BBB are considered speculative in nature and are vulnerable to the possibility of issuer failure or business interruption.

Maturity is the date the principal amount of a bond is to be paid in full. A coupon baring bond pay a stated annual interest payment to the bondholder until it matures. A non-callable bond cannot be redeemed by the issuer prior to maturity regardless of the level of interest rates in the market. Alternative minimum tax is a separate income tax that eliminates many deductions, exclusions and credits and creates a tax liability for an individual who would otherwise pay little or no tax. The interest on certain municipal bonds may be subject to the federal alternative minimum tax.

Cyclicality is the degree to which a credit’s health varies with the performance of the overall economy.

The BBH Intermediate Municipal Bond Fund seeks to protect investors’ capital and generate attractive risk adjusted returns by combining thorough, independent research and a unique valuation discipline to identify undervalued municipal securities.

RISKS

There is no assurance that this investment objective will be achieved. Diversification does not eliminate the risk of experiencing investment losses. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, and inflation risk; investments may be worth more or less than the original cost when redeemed. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. The Fund also invests in derivative instruments, investments whose values depend on the performance of the underlying security, assets, interest rate, index or currency and entail potentially higher volatility and risk of loss compared to traditional stock or bond investments.

For more complete information, visit www.bbhfunds.com for a current Fund prospectus. You should consider the fund’s investment objectives, risks, charges and expenses carefully before you invest. Information about these and other important subjects is in the fund’s prospectus, which you should read carefully before investing.

Shares of the Fund are distributed by ALPS Distributors, Inc. and is located at 1290 Broadway, Suite 1000, Denver, CO 80203. Brown Brothers Harriman & Co. (“BBH”), a New York limited partnership, was founded in 1818 and provides investment advice to registered mutual funds through a separately identifiable department (the “SID”). The SID is registered with the U.S. Securities and Exchange Commission under the Investment Advisers Act of 1940. BBH acts as the Fund Administrator and is located at 140 Broadway, New York, NY 10005. NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE IM-07526-2020-01-30 BBH002873 Exp. Date 04/30/2020

1 With respect to fixed income investments, a margin of safety exists when the additional yield offers, in BBH’s view, compensation for the potential credit, liquidity and inherent price volatility of that type of security and it is therefore more likely to outperform an equivalent maturity credit risk-free instrument over a 3-5 year horizon.

2 One basis point or bp is 1/100th of a percent (0.01% or 0.0001).