The Fed’s cutting of rates was supposed to boost bond prices and create wonderful total returns for fixed income asset classes. Investors have flocked to bonds to capture high yields and lock in those juicy coupons. However, continued uncertainty has plagued the broader economy. In reality, bond yields have continued to rise despite the Fed’s intervention.

Intermediate municipal bonds can help.

Municipal bonds have long been a conservative option for many fixed income seekers. These bonds feature rich tax-advantaged income, low default rates, and an audience that generally prefers a ‘buy & hold’ policy. This has provided many munis with lower volatility versus other asset classes. Given all the volatility about yields and rates, an allocation to intermediate munis could be the answer to strong tax-advantaged income, lower volatility, and better long-term returns.

The Fed & Rate Uncertainty

Going back a year ago and even into mid-2023, the entire focus was on the “rate cut.” After surging inflation had started to recede, the fact that the Federal Reserve was going to cut benchmark rates drove the fixed income markets. Income seekers flooded bonds to lock in yields.

However, despite the Fed cutting rates, bond yields and returns haven’t exactly followed suit.

The benchmark 10-year Treasury Note now has a yield of 4.56%. This is the highest yield for the security in nearly seven months and represents a steady climb after the Fed’s initial rate cut.

The reasons are vast. But inflation and economic/political uncertainty are to blame.

Inflation has fallen from its highs. But recently, it’s been rising and has continued to stay above the central bank’s 2% target. The Consumer Price Index (CPI) rose 0.2% in October and 0.3% in November. Now the annual pace of inflation is sitting at 2.7%. This puts the Fed in a tight spot. Can they further cut rates to accommodate slowing economic growth without risking spiking inflation further? The answer may be no. In the last FOMC meeting, the Fed cut the benchmark rate by only 0.25%.

Going forward, the so-called ‘Dot plot’ has revealed that the Fed now only expected to cut rates twice in 2025- totaling just 0.50% worth of cuts. A year ago, the Fed was predicting a more than 1% cut in 2025.

The path to lower interest rates is now fraught with many starts and stops, which analysts and bond investors were not prepared for. Year-to-date, the bond benchmark the Bloomberg US Aggregate Bond Index (Agg) has a total return of 3.11%. On price, the Agg is showing a loss, with its yield and coupon providing actual positive returns for investors.

Intermediate Munis Win

However, as the bond market grapples with rate uncertainty, a segment of the municipal bond market has been experiencing relatively smooth sailing. Intermediate municipals- those with maturities of two- to ten-years, with five- to seven-years being the sweet spot- have been very stable in the current rate environment. It’s these bonds that could allow investors to have their cake and eat it too. Lock in high yields, win from rate cuts/yield declines, and still provide lower volatility than other bonds.

For starters, the nature of muni bonds themselves. Municipal bonds of all stripes tend to be bought and held to maturity. Historically, the biggest buyers of these sectors have been high-income/net-worth individuals, insurance funds, pensions, endowments, and other institutional investors. These sorts of buyers are looking for a return of principal rather than a return on principal. This is more about buying and holding them to maturity. This has many munis providing lower volatility than other bond varieties.

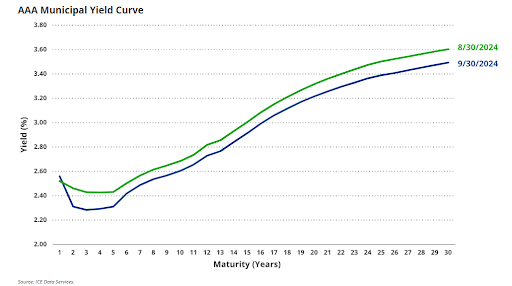

You see this in the fact with regards to the yield curve for AAA muni debt. While the yield curve has been rising for other bonds, munis have experienced lower yields- supporting them amid rate volatility. You can see in one month; munis have experienced overall lower yields.

Source: Van Eck

Intermediate munis are particularly strongly suited for rate uncertainty. Longer bonds in the space may yield more but are subjected to bigger bounces as the ambiguity about the Fed’s path takes hold. The same could be said for the short side- providing low income, but perhaps less bounciness of price. Because of their middle ground, intermediate bonds allow investors to play both worlds- scoring high yields as well as reducing the interest-rate-induced pricing volatility.

The second piece to this comes down to taxes. Thanks to their structure and deals with Uncle Sam, munis are often free from Federal taxes as well as potentially state/local taxes. This high after-tax yield provides additional benefits in this environment. This added “extra” yield post-taxes can provide more cushion than taxable yields. This also adds to munis’ lower volatility when it comes to difficult-to-navigate interest rate environments.

Betting Big On Intermediate Munis

Given the benefits of intermediate munis for all the rate uncertainty and continued volatility, investors may want to bet big on these bonds. Luckily, the vast bulk of the funds in the municipal bond sector tend to cover this swath of securities. Most funds have an intermediate tilt.

The only direct play could be the VanEck Intermediate Muni ETF which hones in directly on bonds with maturities right within the sweet spot of 5 to 7 years. However, there are plenty of other ways to get your muni fix within this sector- both active and passive. Active could be a could choice as managers could pick out the best bonds in this area.

Intermediate Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their one-year total return, which ranges from 2.4% to 5%. They have expense ratios between 0.05% to 0.65% and have assets under management between $930M to $34B. They are currently offering yields between 1.5% and 4.1%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.8B | 5% | 2.98% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 4.9% | 3.4% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $34B | 4.3% | 2.64% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | 4.4% | 2.79% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $933M | 3.1% | 4.1% | 0.19% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 2.4% | 1.5% | 0.20% | ETF | No |

In the end, municipal bonds can offer solace in the current rate uncertainty and intermediate munis offer the biggest benefits. Featuring the right amount of yield and low price volatility, they can be the best way to play the Fed’s rate ambiguity. Adding a dose of these funds makes sense in the current environment.

Bottom Line

Rates and yields have continued to bounce around, leaving many fixed income investors puzzled and seeing losses. But there is an answer. Intermediate muni bonds. These bonds offer high enough yields and lower price volatility than many other bonds, providing a great place to shelter from the storm.